In the midst of global conditions full of pollution and economic slowdown, Indonesia has succeeded in maintaining economic stability. Data from the Central Statistics Agency (BPS) shows that in the third quarter of 2023, Indonesia’s economic growth will still grow by 4.94% (yoy). Even though there was a slight slowdown compared to the previous quarter which reached 5.17% (yoy), the government remains optimistic that economic growth will remain above 5% until the end of 2023. However, in the future, the global economy will still be hampered by various obstacles, such as slowing economic growth in China and America, as well as unstable geopolitical conditions such as the conflicts in Ukraine and Palestine-Israel, all of which can affect the Indonesian economy.

Moving into 2024, Indonesia’s economic growth will continue to be supported by a number of sectors. The main sector that is expected to drive growth is the manufacturing sector, which has shown positive growth for some time. Apart from that, the agricultural sector is also expected to make a significant contribution, considering the importance of this sector in providing food for the community. Apart from that, the service sector, especially the financial services and information technology sectors, is also expected to continue to develop and make a major contribution to economic growth. Nevertheless, challenges remain, especially in dealing with commodity price volatility and the potential for climate change which could affect the agricultural sector. In facing these various challenges, coordination and appropriate policies from the government will be the key to ensuring sustainable economic growth for Indonesia.

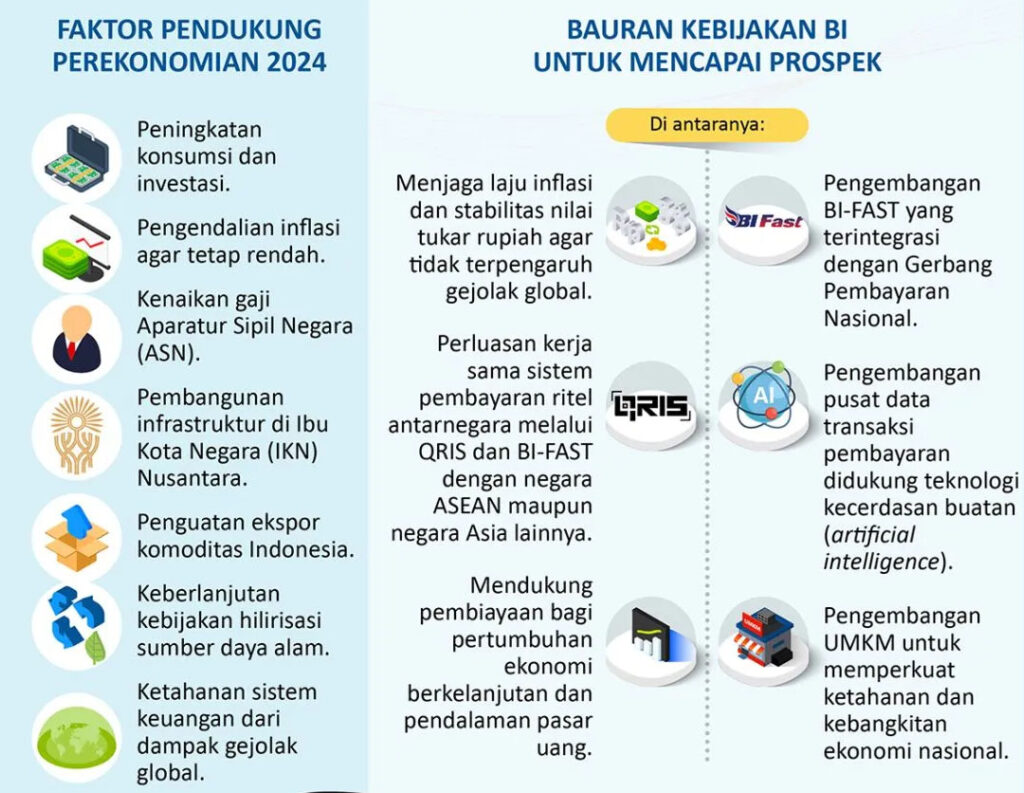

Bank Indonesia (BI) Policy Mix in 2024 reflects its commitment to maintaining Indonesia’s economic stability amidst global conditions full of uncertainty and risk. One of the main focuses is to maintain the rate of inflation and stability of the rupiah exchange rate so that it is not affected by global turmoil. BI will continue to take appropriate steps to face this challenge, including through monetary policy that is accommodative but maintains balance to prevent potential inflationary pressures.

Apart from maintaining exchange rate stability and inflation, BI is also actively expanding cooperation in retail payment systems between countries, especially with countries in the ASEAN region and other Asia. This effort is carried out through BI-Fast, a payment system that allows retail transactions between countries to be carried out more efficiently and quickly. With this collaboration, it is hoped that it can strengthen economic integration between countries and increase regional connectivity, which can support overall economic growth.

Apart from that, BI policy is also aimed at supporting financing for sustainable economic growth and money market deepening. This is important to increase access to financing for business actors, especially in the midst of uncertain global economic conditions. Thus, BI policy in 2024 is expected to make a positive contribution to Indonesia’s economic growth and maintain overall economic stability. These steps are part of BI’s strategy to maintain Indonesia’s economic stability amidst uncertain global economic dynamics. (DD.Akbar)